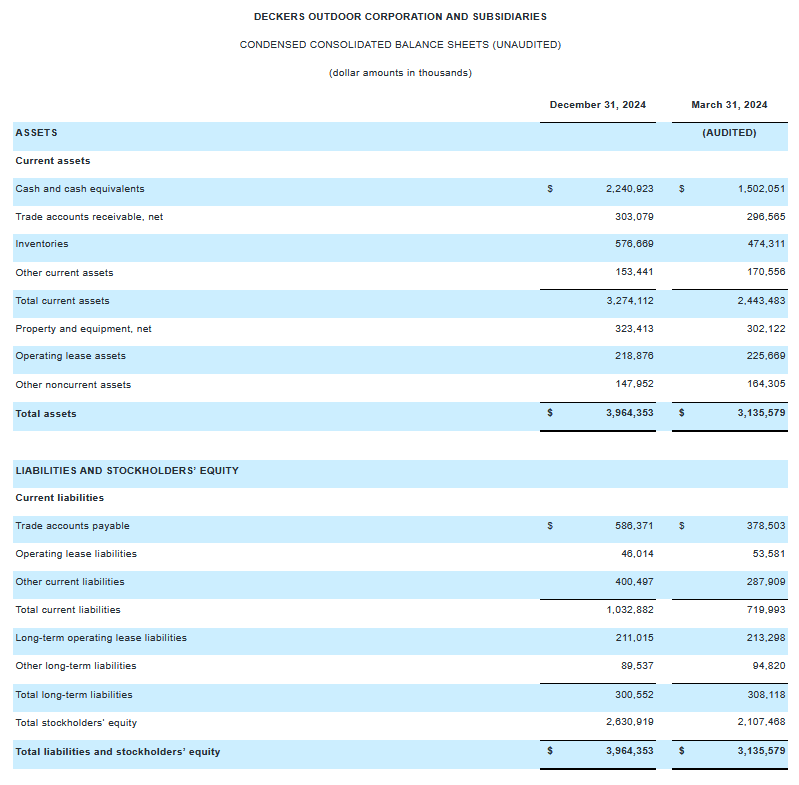

Company Overview & Financial Structure

Assets & Liabilities: The company reports approximately $4 billion in assets versus $1 billion in liabilities.

Outstanding Shares: There are 151,820,000 shares outstanding, with about 5.5 million shares reserved by the company for employee compensation.

Core Business: UGG and HOKA brands constitute approximately 92% of Decker’s revenue. The company primarily sells footwear.

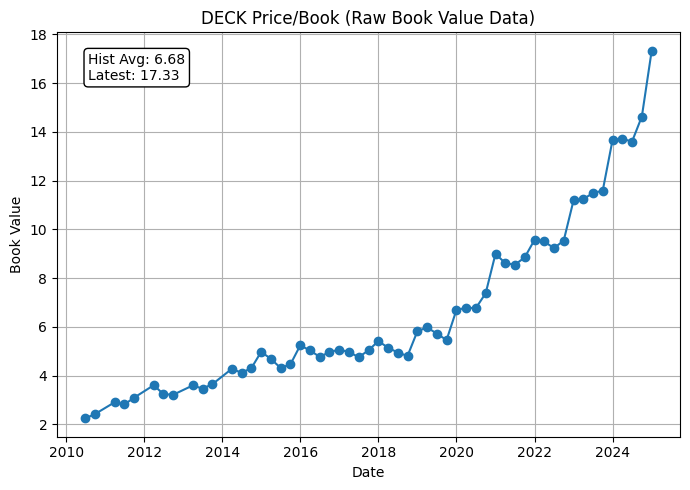

Book Value

The Price-to-Book (P/B) ratio is 6.75.

Book value per share has increased by 26.8% year-over-year (YoY) and has a compound annual growth rate (CAGR) of 21.0% over the last five years.

This results in a 1-year Price-to-Book-to-Growth (PBG) ratio of 0.25 and a 5-year PBG ratio of 0.32.

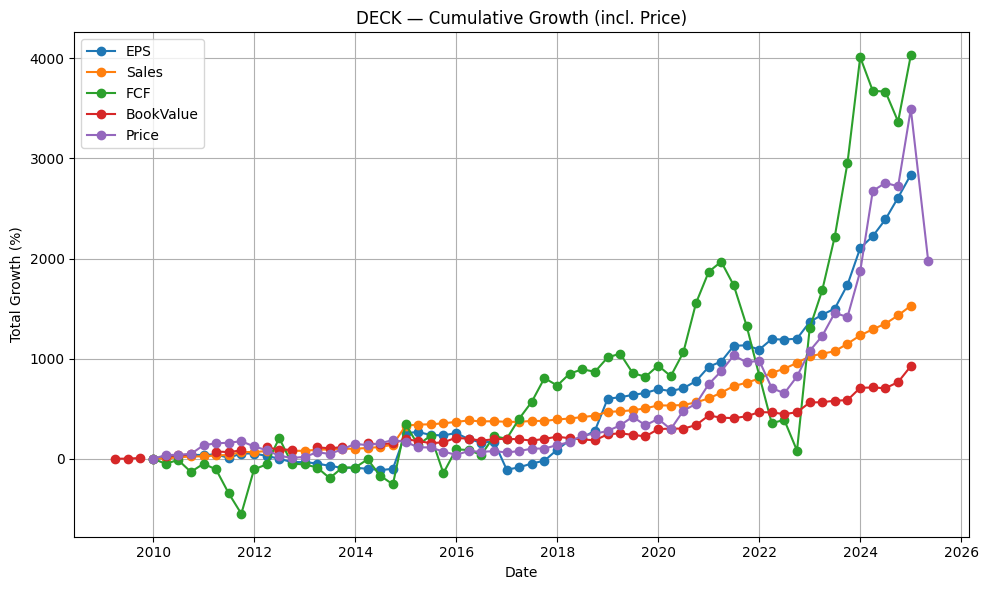

Revenue

The Price-to-Sales (P/S) ratio stands at 3.65.

Sales per share has shown YoY growth of 22.2% and a CAGR of 20.8% over the past five years.

This leads to a 1-year Price-to-Sales-to-Growth (PSG) ratio of 0.16 and a 5-year PSG ratio of 0.18.

Free Cash Flow

The shares are trading at a multiple of 17.71 times FCF.

FCF per share has experienced growth of 0.5% in the last year and a CAGR of 32.0% over the past five years.

This yields a 1-year Price-to-FCF-to-Growth (PFCFG) multiple of 38.84 and a 5-year PFCFG multiple of 0.55.

Earnings

The Price-to-Earnings (P/E) ratio is currently 18.98.

Earnings Per Share (EPS) has demonstrated YoY growth of 33.3% and a CAGR of 29.9% over the last five years.

This results in a 1-year Price-to-Earnings-to-Growth (PEG) ratio of 0.57 and a 5-year PEG ratio of 0.64.

Valuation Ratios for DECK:

• P/E Ratio : 20.37

• P/S Ratio : 3.91

• P/B Ratio : 7.25

• P/FCF Ratio: 19.00

-- Latest TTM Values --

• EPS (TTM) : 6.17

• Sales per Share (TTM) : 32.09

• Book Value per Share : 17.33

• FCF per Share (TTM) : 6.61

• Last Share Price : 125.62

Earnings-per-Share – YoY: 33.26% | 5-Y CAGR: 29.86%

Sales-per-Share – YoY: 22.25% | 5-Y CAGR: 20.80%

Free-Cash-Flow/share– YoY: 0.46% | 5-Y CAGR: 31.98%

Book-Value/share – YoY: 26.77% | 5-Y CAGR: 20.96%

Recap of key growth ratios for DECK:

• 1Y PEG : 0.612423 5Y PEG : 0.682240

• 1Y PSG : 0.175749 5Y PSG : 0.187981

• 1Y PFCFG: 41.673333 5Y PFCFG: 0.594201

• 1Y PBG : 0.270786 5Y PBG : 0.345903

Macro Risks and How Deckers Is Addressing Them

In its Q3 FY2025 earnings call, Deckers Outdoor Corp. reported strong financial performance but also acknowledged several macroeconomic headwinds that could impact future quarters. What stood out was management’s emphasis on maintaining long-term brand health over chasing near-term gains. Below is a summary of the key concerns raised, along with management’s stated approach to handling them.

Foreign Exchange Volatility

Issue: Foreign exchange (FX) rates, which provided a slight benefit in Q3, have since turned unfavorable and are expected to become a headwind in Q4.

Commentary:

“We have since seen rates move against us, and as a result, expect to face an FX headwind in the upcoming quarter.”

“Macro conditions that are impacting our gross margins… we really don't have much control over in that respect.”

Increased Freight Costs

Issue: Freight rates have normalized and are now a meaningful drag on gross margins compared to last year, when unusually low costs provided a benefit.

Commentary:

“This Q4, we’re anticipating a fairly significant freight hit — probably in the 150 basis point range.”

“Last year’s unsustainably low freight rates are not repeating.”

More Promotional Activity and Closeouts

Issue: Deckers expects higher levels of product closeouts in Q4, particularly due to seasonal transitions and model upgrades (e.g., the shift from Clifton 9 to Clifton 10).

Commentary:

“We might experience some more closeouts… and some additional closeouts in Q4 to move that inventory out.”

“We're not chasing outsized numbers just for the sake of delivering a higher number.”

Recession Risk and Consumer Confidence

Issue: While not currently impacting performance, management noted that a deterioration in consumer confidence or broader economic conditions could affect results.

Commentary:

“Our guidance assumes no meaningful deterioration… including changes in consumer confidence and recessionary pressures.”

“We're not going to be in a position to trade brand equity for short-term revenue.”

SG&A Inflation

Issue: Selling, general and administrative expenses rose as a percentage of revenue, driven by inflation, currency remeasurement, and strategic hiring.

Commentary:

“SG&A was 29.3%, up from 27.5%… driven by increased marketing spend, foreign currency exchange rate remeasurement, and higher head count.”

“We’re continuing to invest responsibly to support long-term sustainable growth.”

Inventory Constraints

Issue: Strong sell-through in Q3, particularly for the UGG brand, has left less inventory available for Q4, limiting potential revenue despite robust demand.

Commentary:

“Given how strong UGG has performed… we are limited in the fourth quarter by available inventory left to sell.”

“We run a scarcity model… it continues to drive brand heat and demand.”

Geopolitical and Supply Chain Risk

Issue: These broader risks are not currently disrupting operations but are acknowledged in the company’s forward-looking guidance assumptions.

Commentary:

“Our guidance assumes no meaningful deterioration of current risks… including supply chain disruptions and geopolitical tensions.”

“Our flexible model and disciplined brand management help us remain resilient.”

Conclusion

Deckers' management remains focused on long-term brand integrity, pricing power, and disciplined expansion, even as macroeconomic conditions become more complex. The approach is cautious but calculated. As demand remains strong and international markets grow, the company is positioning itself to absorb volatility without compromising its strategy.compromising strategy.

BONUS TABLE!!!!!!!!!!!!

Since the last report, I've managed to add a valuation table with multiple P/E levels and different CAGR rates.

The above table provides both FCF and P/E growth estimates for a 5-year outlook, discounted by 10% at various multiple levels. No terminal value cause why add more uncertainty. Alright. Later.