You know the drill. Balance Sheet.

Balance Sheet:

Assets: $276B

Debt: $28.8B

Other liabilities leave Equity at $182B

Market Cap: $1.38T

Dilution:

I have an initial scan that helps me here by selecting tickers known for their past historical growth. There is the concern of dilution and the number of shares that a company has already set aside for future employee compensation. There’s no real way of getting those numbers besides reviewing the filing and asking the AI (don’t worry, I double-check). This is where that concern comes in: META has 483 million shares reserved for future issuance to employees. Of a total of 2.61 billion shares outstanding, these future issuance shares represent 19% of the total float. Shares used in the computation of diluted EPS are higher than the generally stated 2.5 billion shares outstanding; all other measures going forward use this higher value to account for RSUs.

So, there’s your dilution risk. I’ll provide the caveat, just in case The Zuck suddenly becomes “Employee of the Decade” and gifts himself a cool 483 million shares. (The likelihood is unlikely—let’s pretend that doesn’t happen.)

Book Value:

P/B Ratio: 7.58

YoY book value growth per share: 20.5%

5-year CAGR: 15.25%

PBG Ratios: 0.37 for YoY and 0.49 for the 5-year view

Sales:

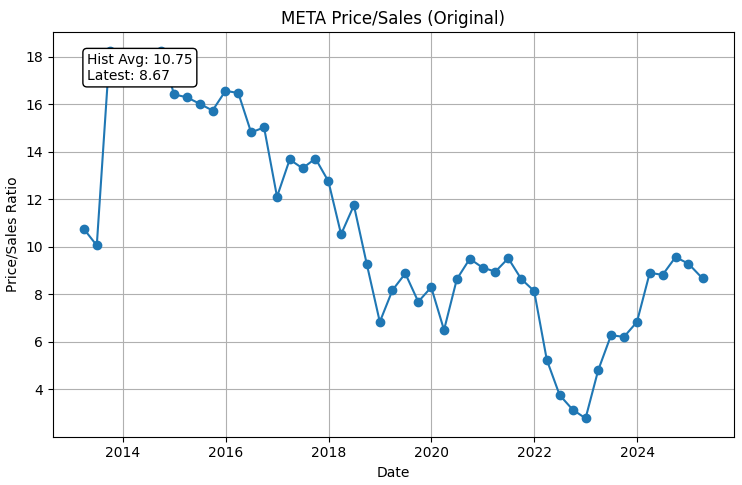

P/S Ratio: 8.67

YoY Sales Growth: 22.36%

5-year CAGR: 20.68%

Ratios: 0.38 for the last year and 0.41 for the five-year period

P/E Ratio: 22.84

Earnings per Share – YoY Growth: 60.54%

5-year CAGR: 30.00%

1-year PEG: 0.377290; 5-year PEG: 0.761448

Free Cash Flow:

P/FCF Ratio: 26.41

Free Cash Flow per Share – YoY Growth: 23.45%

5-year CAGR: 22.89%

1-year PFCFG: 1.126289; 5-year PFCFG: 1.153957

A little high—not overvalued but near fairly priced.

To recap.

Valuation Ratios for META:

• P/E Ratio: 22.84

• P/S Ratio: 8.67

• P/B Ratio: 7.58

• P/FCF Ratio: 26.41

Earnings per Share - YoY Growth: 60.54%, 5Y CAGR: 30.00%

Sales per Share - YoY Growth: 22.36%, 5Y CAGR: 20.68%

Free Cash Flow per Share - YoY Growth: 23.45%, 5Y CAGR: 22.89%

Book Value per Share - YoY Growth: 20.50%, 5Y CAGR: 15.25%

key growth ratios for META:

• 1Y PEG: 0.377290 5Y PEG: 0.761448

• 1Y PSG: 0.387702 5Y PSG: 0.419332

• 1Y PFCFG: 1.126289 5Y PFCFG: 1.153957

• 1Y PBG: 0.369788 5Y PBG: 0.496959

Throw in a Book that isn’t going insolvent any time soon. 4.5/5 Stars.Litigation

• Irish Data Protection Commission Fine

In May 2023, the Irish Data Protection Commission (IDPC) issued a final decision finding that Meta Platforms Ireland’s reliance on Standard Contractual Clauses for certain transfers of European Economic Area (EEA) Facebook user data was not in compliance with the EU General Data Protection Regulation (GDPR). The IDPC imposed an administrative fine of 1.2 billion Euro and issued orders requiring Meta to suspend and bring its data transfers into compliance. Meta is appealing the decision.• FTC Litigation and Consent Order

Meta continues to face litigation from the U.S. Federal Trade Commission (FTC). The amended complaint alleges anti-competitive conduct, including Meta’s acquisitions of Instagram and WhatsApp. The FTC seeks equitable relief, including potential divestiture of Instagram and WhatsApp. Meta’s motion to dismiss was denied in January 2022; motions for summary judgment from both sides were granted in part and denied in part in November 2024, and trial is set for April 2025.• Consumer Financial Protection Bureau Investigations

In September 2024, staff of the CFPB initiated a process indicating the agency may recommend enforcement action, alleging Meta’s receipt and use of financial information violated the Consumer Financial Protection Act. If the CFPB moves forward, it may seek financial penalties and other equitable relief. Meta disputes these allegations and responded through the CFPB’s process.• “Social Media Addiction” Lawsuits

Starting in January 2022, numerous lawsuits were filed in the U.S., Brazil, and Canada, asserting that Facebook and Instagram cause “social media addiction,” especially among users under 18, leading to mental health harms. Certain claims include allegations of violating child protection laws. Public entities like school districts have joined some suits as plaintiffs. These lawsuits generally seek monetary damages and/or injunctive relief.• Artificial Intelligence Copyright Cases

In 2023 and 2024, multiple class actions (Kadrey, et al. v. Meta Platforms, Inc.) alleged Meta used copyrighted materials to train its AI models without permission, seeking damages and injunctive relief. These cases are consolidated in the U.S. District Court for the Northern District of California.• Various Advertising-Related Lawsuits

Meta is defending a number of claims related to its ad products. For example, consolidated class actions allege inflated estimates of potential ad audience sizes or improper receipt of data from third-party websites and apps. Some of these are still in discovery, and some of Meta’s motions to dismiss have been denied in part; the plaintiffs in a few matters are seeking unspecified damages and injunctive relief.The Future.

1. AI. (See GOOGL post)

2. Putting ads in the Metaverse.

3. Monetizing WhatsApp, Messenger and Instagram.

4. Operational and Cost Efficiency.

5. Make Sure Everyone Knows About Us On The Planet.

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e