Assets

Total Assets: $6.2 billion

Cash: $2.17 billion

Houses: $1.7 million

Contract Land Deposits: $757 million

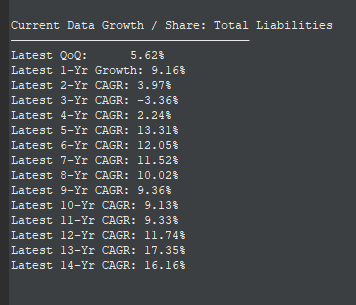

Total Liabilities: $2.24 billion

Liquidity appears robust, as cash alone is sufficient to cover liabilities, indicating a strong financial position.

Revenue

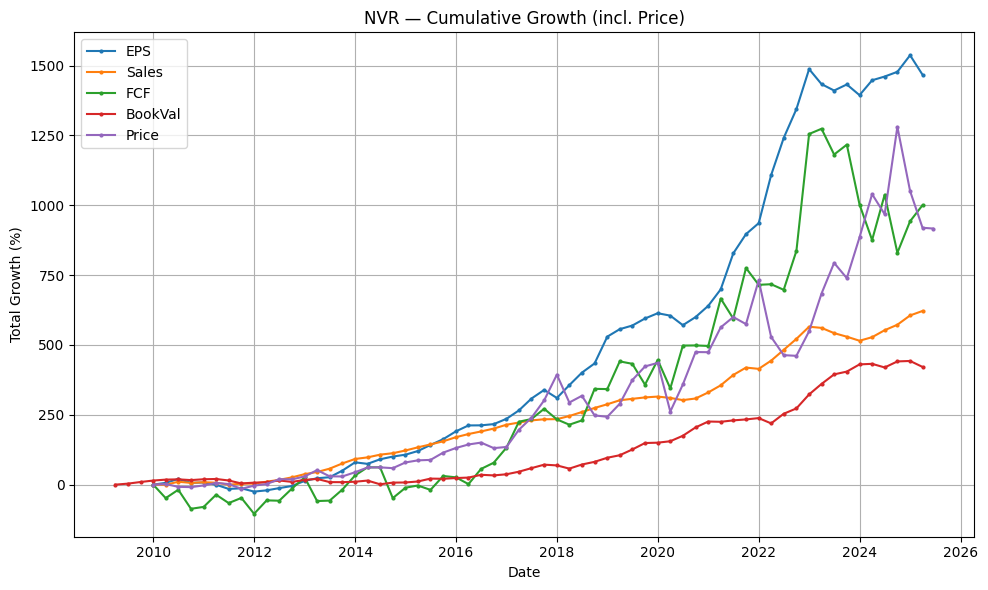

Consistent 12% revenue-per-share growth historically.

Current Price-to-Sales (P/S) ratio is somewhat elevated compared to historical averages.

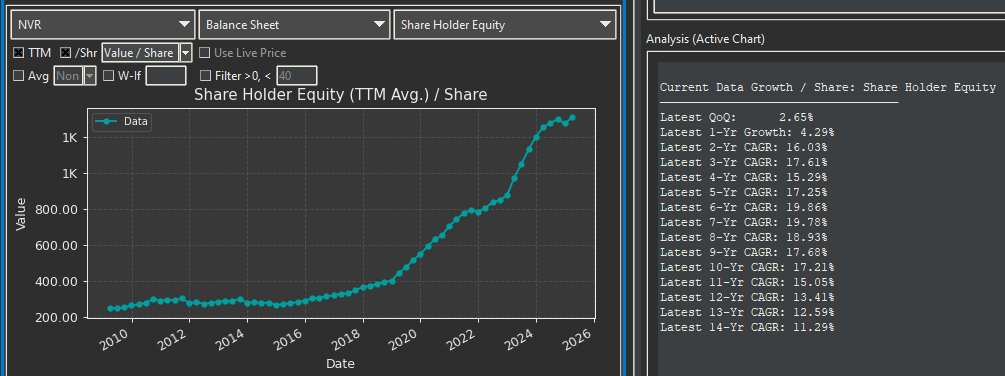

Book Value

Solid book value growth at around 15%, comfortably situated within historical valuation multiples.

Liabilities growth ranges from 9% to 11% annually, while asset growth remains robust between 12% and 15%.

Earnings, Free Cash Flow (FCF), Cash from Operations (CFFO), and Margins

Renewed emphasis on growth combined with historically attractive valuation multiples.

NVR stands out with a rare blend of a low Price-to-Earnings-Growth (PEG) ratio (0.71) and attractive historical multiples.

10-year Compound Annual Growth Rate (CAGR) for earnings stands at approximately 20%, supported by a current P/E ratio of 14.38, which is notably below its historical median of 18.35.

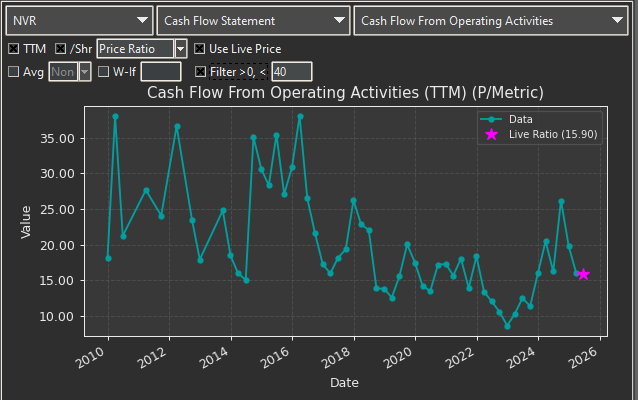

Cash Flow From Operating (CFFO) & Free Cash Flow (FCF)

Call it 15%

Undervalued or Fairly Valued. But it’s not overvalued in this regard.

Free Cash Flow (FCF)

Current Price-to-Free-Cash-Flow (P/FCF) ratio is 16, juxtaposed against a robust 20% growth in FCF (Trailing Twelve Months), yielding an appealing growth ratio of 0.8.

EBIT and EBITA

EBIT and EBITA growth rates are approximately 16%.

EBIT and EBITA margins hover around 11%, slightly below the historical median of 12%, yet comfortably beneath current growth rates, suggesting attractive valuation metrics.

Margins and Returns (ROA/ROE)

Return on Assets (ROA) at 25% and Return on Equity (ROE) at 40%, both metrics exhibiting steady improvement over time.

Margin performance is solid:

Gross Margin: 25%

Operating Margin: 19.59%

Net Margin: 15%

Discounted Cash Flow (DCF) Valuation

Earnings Per Share (EPS): $502.45 with projected growth at 20%.

Applying a historical median P/E multiple of 18 suggests a valuation nearly double its current market price, highlighting potential undervaluation.

with a share price of 7,225 It can certainty feel like it can be overlooked on just that price alone. But value is value no matter the price.

Overall, NVR presents a compelling investment case characterized by robust growth metrics, healthy margins, and attractive valuation multiples. The strong cash position significantly exceeds liabilities, underscoring financial stability. Given the combination of sustained earnings growth, historically low valuation multiples, and strong financial health, NVR appears potentially undervalued relative to its long-term performance and prospects.

And that’s at the median P/E if we state that the Price = Earnings Growth Rate (we can assume 20%) it looks like this. Mid 9000s

Back to all-time highs but this is the rosiest picture.