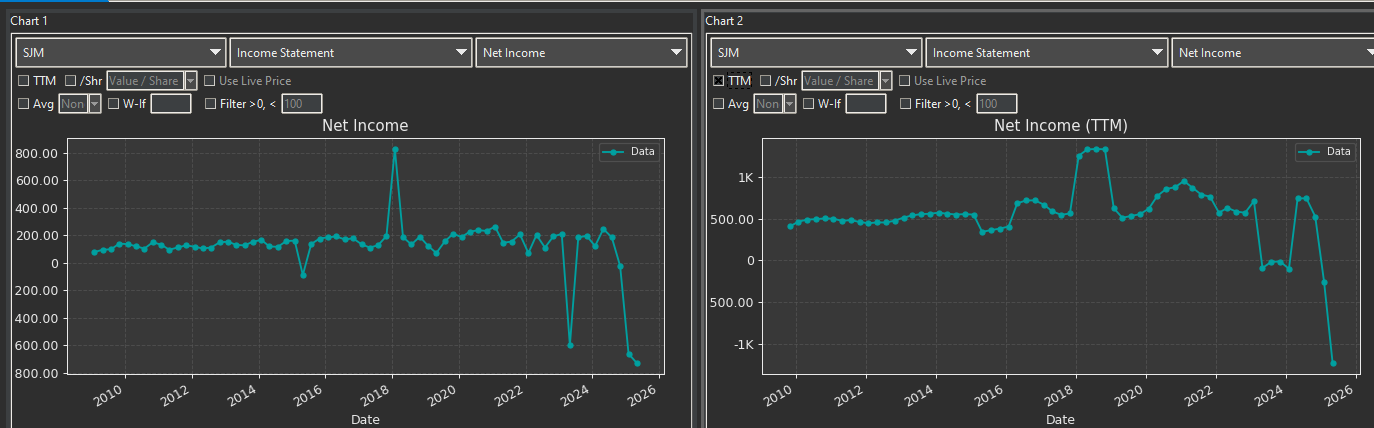

In November 2023, JM Smucker completed its $5.6 billion acquisition of Hostess Brands. Since then, SJM has recorded multiple goodwill impairment charges related to the deal. This article aims to show how impairment charges can affect financial metrics and distort commonly used indicators potentially discouraging investors from considering the stock.

Frightening. At first glance, it looks like SJM can’t even turn a profit on Uncrustables. Seems like an open-and-shut case. But let’s look at revenue.

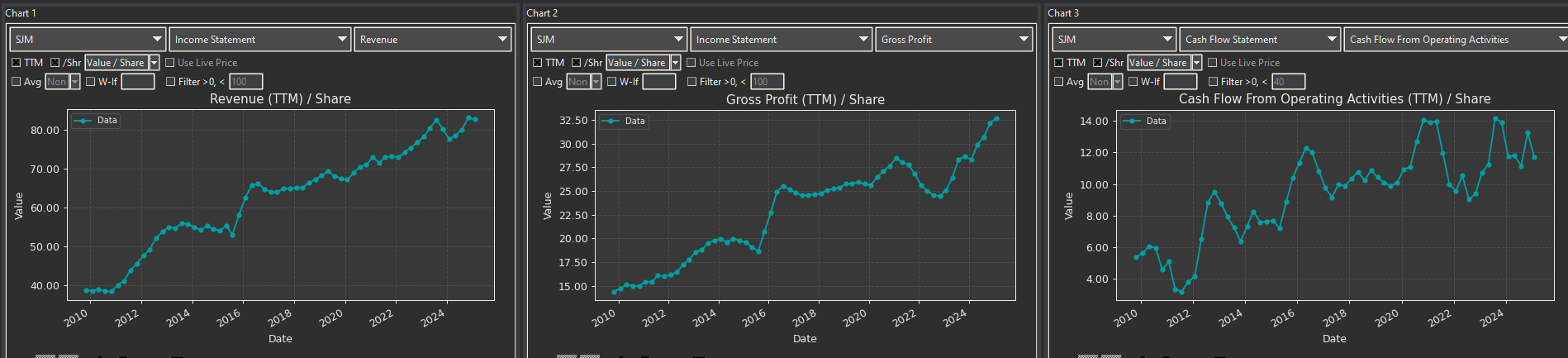

Rising revenue.

So the next question is: is the issue operational, or is it related to COGS?

COGS isn't the issue.

Maybe it's SG&A?

No spike in SG&A.

Maybe taxes?

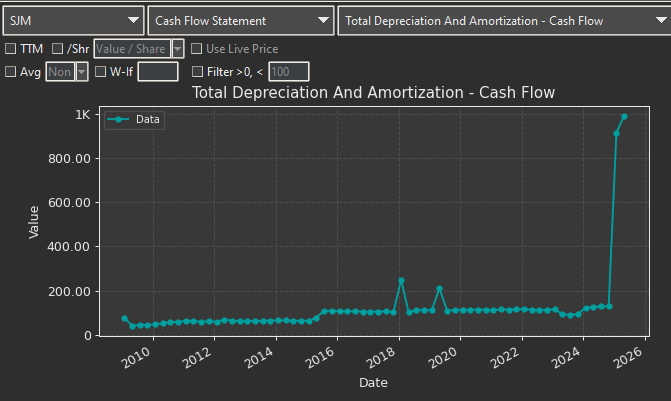

You can draw the same conclusion by using EBITDA.

The impact of the impairment charges clearly shows up in operating and net profit margins. Yet, SJM still maintains a strong gross margin.

Let’s check the drawdown.

The drawdown stems from the Hostess acquisition not being as sweet as expected.

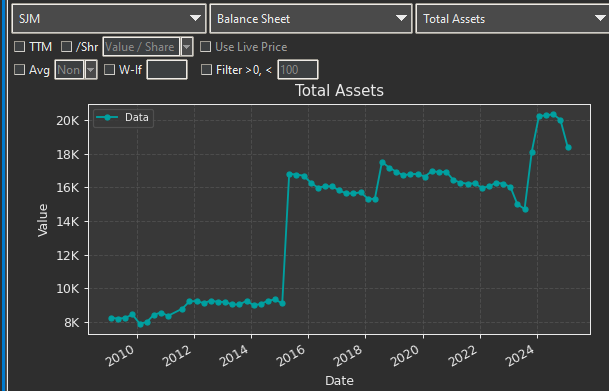

Thanks for sticking around. Let’s look at the balance sheet. It's now mostly goodwill total assets rose from $13 billion to $18 billion. Total liabilities stand at $11.5 billion.

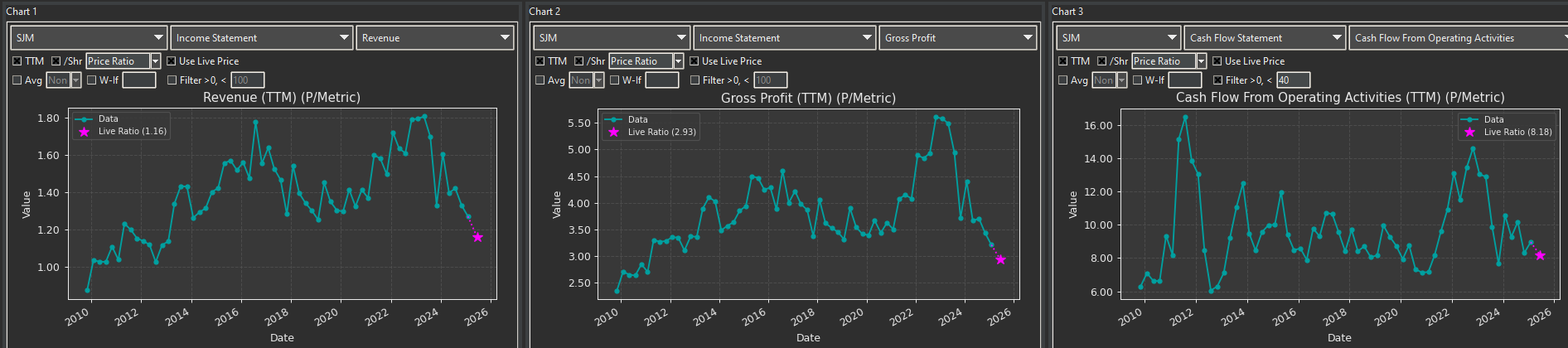

Revenue.

SJM is currently trading at its lowest price-to-sales (P/S) ratio in 12 years, despite posting about 3% growth across multiple time frames.

Now I’m interested. With negative EPS keeping SJM off many screeners, let’s dig a bit deeper.

Free Cash Flow (FCF):

I don’t like the outliers on the price-to-FCF (P/FCF) ratio. Let’s filter out values above 22.

Now it's sitting around the historical median.

FCF growth:

Still erratic just 3–4% CAGR when comparing 2010 to now. EPS grew from $3.70 in 2010 to $7.67 in 2025.

CFFO

Around 4% growth. The more data you gather, the more this becomes an art rather than a science. Trades around a 9 P/CFFO than at 8.

To recap:

This isn’t a growth story. It’s a case study in how goodwill impairments can skew key metrics perhaps unfairly so.