What Does Walgreens Do?

Walgreens Boots Alliance (WBA) is primarily a pharmacy retailer and healthcare distributor with operations spanning prescription drugs, retail sales, and healthcare services.

1. Pharmacy & Prescription Drugs (Core Business)

Retail Pharmacies: Operates 8,000+ Walgreens stores in the U.S. and Boots pharmacies in Europe.

Prescription Fulfillment: Fills millions of prescriptions annually, acting as a middleman between drug manufacturers and consumers.

Pharmacy Benefits & Insurance Relationships: Works with insurers and pharmacy benefit managers (PBMs) to handle drug pricing and reimbursements.

2. General Retail Sales

Sells over-the-counter medicine, beauty products, personal care items, and convenience goods inside its stores.

Competes with CVS, Walmart, Amazon, and supermarkets for consumer health and wellness sales.

3. Healthcare Services Expansion (Trying to Compete with CVS)

VillageMD: Investing in primary care clinics inside Walgreens locations.

Shields Health Solutions: Manages specialty pharmacy services for complex medications.

CareCentrix: Provides home healthcare and post-acute care services.

4. Wholesale Drug Distribution

Owns Alliance Healthcare, one of the largest pharmaceutical distributors in Europe, supplying hospitals, clinics, and independent pharmacies.

What Walgreens Owns (Assets)

As of November 30, 2024, Walgreens Boots Alliance (WBA) reported $75.5 billion in total assets. These assets fall into two main categories: current assets (short-term resources) and non-current assets (long-term investments and property).

Current Assets ($17.5B)

Cash & Cash Equivalents: $859M

Marketable Securities: $332M

Accounts Receivable (Money Owed to Walgreens): $6.19B

Inventories (Products on Shelves): $9.1B

Other Current Assets: $977M

Non-Current Assets ($61.0B)

Property, Plant, & Equipment (Stores, Warehouses, etc.): $9.3B

Operating Lease Right-of-Use Assets (Long-Term Store Leases): $19.6B

Goodwill (Intangible Value from Acquisitions): $15.4B

Intangible Assets (Patents, Brand Value, etc.): $12.5B

Equity Investments (Stake in Other Companies): $2.1B

Other Non-Current Assets: $1.36B

What Walgreens Owes (Liabilities & Debt)

Walgreens has $67.2 billion in total liabilities, meaning the company has significant financial obligations. These liabilities are divided into current (short-term) and non-current (long-term) debts.

Current Liabilities ($27.4B)

Short-Term Debt: $446M

Trade Accounts Payable (Money Owed to Suppliers): $14.5B

Operating Lease Obligations: $2.3B

Accrued Expenses & Other Liabilities (Unpaid Bills & Payroll): $9.6B

Income Taxes Owed: $392M

Non-Current Liabilities ($39.8B)

Long-Term Debt: $7.6B

Operating Lease Obligations (Long-Term Rent Commitments): $20.2B

Deferred Income Taxes: $1.1B

Accrued Litigation Obligations (Legal Costs & Settlements): $5.9B

Other Non-Current Liabilities: $4.8B

Equity (Shareholder Value)

After subtracting liabilities from total assets, Walgreens has $11.1 billion in total equity, meaning this is what theoretically belongs to shareholders.

Retained Earnings: $22.9B

Paid-in Capital: $10.5B

Treasury Stock (Stock Buybacks Reducing Equity): -$20.5B

Accumulated Other Comprehensive Loss: -$2.9B

With a Market Cap of 8.88 Billion as of Jan 31. Would make us consider the intrinsic value of things like Inventories, the likelihood of WBA getting payments from accounts payable, store lease values, goodwill and intangibles which quickly dwindle the value available. What store charges full price for items during a bankruptcy sale?

With a snapshot of the assets and liabilities we can now turn to the historical growth of WBA. In both Assets and Liabilities.

Total Assets Growth (2010–2024 vs. Latest: $75.5B)

2010: ~$100B

2015: ~$150B

2020: ~$300B

2024 (Chart Estimate): ~$375B

Latest Reported (Nov 30, 2024): $325.5B

Growth from 2010 to Peak (~2024 Chart): +325%

Drop from Peak (375B → 325.5B): -13%

Walgreens' total assets peaked in recent years but have since declined recently.

And now for Liabilities

Total Liabilities Growth (2010–2024 vs. Latest: $67.2B)

2010: ~$45B

2015: ~$100B

2020: ~$250B

2024 (Chart Estimate): ~$275B

Latest Reported (Nov 30, 2024): $267.2B

Growth from 2010 to Peak (~2024 Chart): +593%

Drop from Peak (275B → 267.2B): -3%

Like assets, liabilities have also decreased, but they remain high relative to total assets.

Key Takeaway: Liabilities Still Dominate Assets

Latest Assets (Nov 2024): $325.5B

Latest Liabilities (Nov 2024): $267.2B

Assets-to-Liabilities Ratio: 1.21x (Assets barely cover liabilities)

While both assets and liabilities have fallen from their peak, liabilities are still very close to total assets, suggesting that Walgreens is in a tight financial position with limited margin for error.

Walgreens Boots Alliance (WBA) generates revenue primarily from prescription drug sales, retail sales, and healthcare services. However, profitability has been under pressure due to shrinking margins and rising costs.

Whats the point of doing this. We have Equity! (along with all the aforementioned caveats)

Yikes. But is it? Lets look at Equity Per Share.

Given its trading below or near its Equity per share. And with an eye on the assets that WBA owns it could very well be near a value that is attractive to those who can stomach the uncertainties of the value of its merchandise, locations, accounts payable and goodwill. A buyout perhaps?

What Walgreens Makes

Walgreens brings in revenue and profits, but its earnings are under pressure. While the company is still generating billions, profitability has been volatile due to rising costs, debt obligations, and industry challenges.

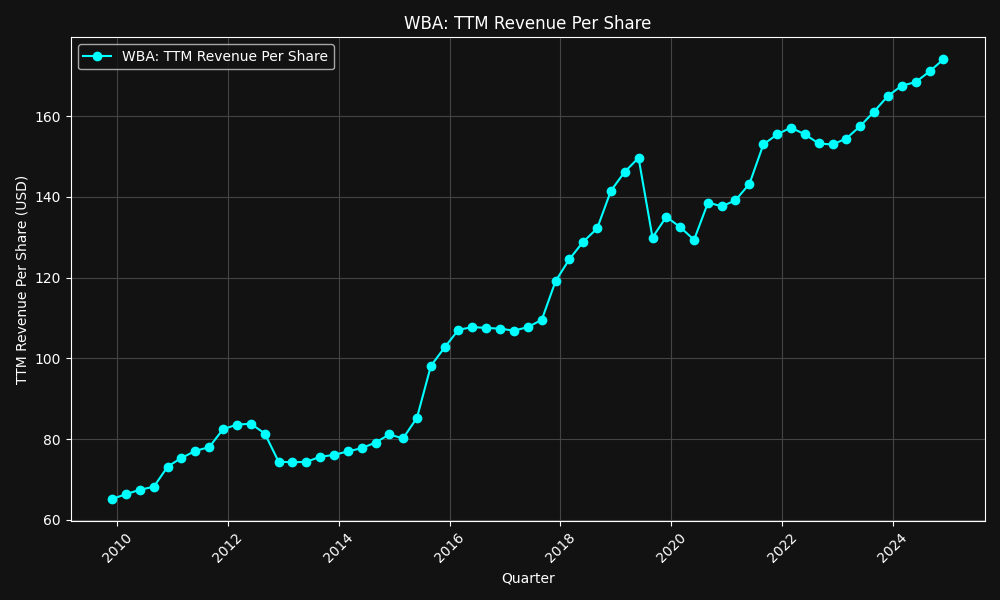

1. Total Revenue

Walgreens' total revenue has grown over time, reaching over $150B annually.

However, revenue growth has slowed in recent years, raising concerns about long-term sustainability.

What about the share count? how does that fit in.

WBA has halted share buybacks since 2020/2021 making the revenue growth that much more impressive while this is good, the net income explains the reason for the share price.

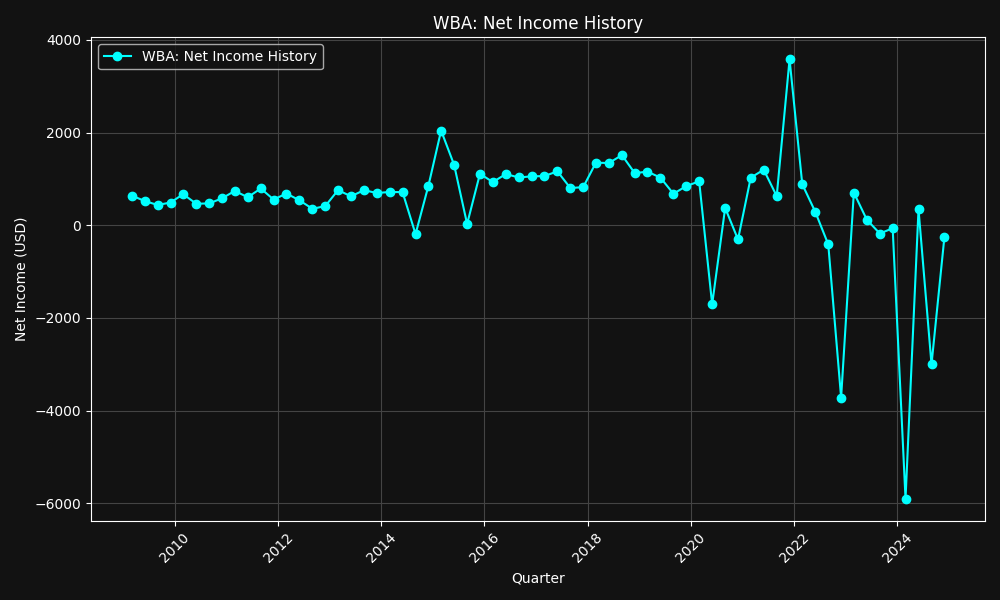

Net Income (Profit After Expenses)

3. Total Net Income

Walgreens remains profitable, but net income has been inconsistent.

(Insert correlation isnt causation joke here)

The quarterly is even more umm… unstable.

Well were not missing on revenue, so it has to be costs. What costs have been growing under WBA that has been hampering its ability to turn its revenue into net income.

Last quarter was an roughly 40B in Operating Expenses + Cost of Goods Sold (COGS). Of that, COGS were 33B of the 40B leaving 7B to be based on how efficient the company is in selling its products.

Given that COGS is the majority of costs preventing WBA from turning its revenue into profit. What has WBA done or plans to do to reduce these costs. For this we turn to the latest 10-Q to see how they report.

Consider that 20B of the 40B in costs for WBA is in stocking the pharmacies. Though their agreement with Cencora, Cencora provides branded and generic pharmaceutical products.

Theres no further discussion on how to reduce costs with Cencora in the filing. WBA owns 10% of Cencora and probably does so to reduce prices during wholesale purchases.

Assuming exclusivity with this agreement, that leaves 12B in costs for????

Retail.. The worst part of WBA. Assuming a targeted store closure that optimizes for a loss in retail revenue over pharmacy revenue. The costs from the closures of an 8th of their stores will impact what 2-3B in savings a quarter + the reduction in SG&A (assuming 5B total) thats a 12% reduction in costs that would materially increase its EPS. So where does that leave us.

How It Grows

Growth for Walgreens comes in two main forms:

Improving Profitability (Cutting Costs, Increasing Efficiency).

Increasing Revenue (More Customers, Higher Market Share).

1. Improving Profitability (Cost Reduction Strategy)

COGS accounts for $33B of total $40B expenses.

Pharmacy supply chain (via Cencora) is the largest cost driver (~$20B).

No clear cost-cutting initiatives for Cencora were mentioned in filings.

Retail footprint is costly (~$12B in costs).

Store closures could optimize pharmacy revenue while reducing retail overhead.

Shutting down 1/8 of stores could save ~$2-3B per quarter (plus lower SG&A).

SG&A (Selling, General & Administrative) costs are ~$5B per quarter.

Reducing labor and lease expenses through automation or strategic closures would increase EPS.

2. Increasing Revenue (Customer & Market Expansion)

Expanding healthcare services (VillageMD, Shields Health) could drive higher-margin revenue.

Digital pharmacy & e-commerce growth is an opportunity, but currently lags behind Amazon & CVS.

Retail sales strategy needs improvement—shifting towards profitable, higher-margin products could help.

The changes displayed here could be done as if WBA was already taken over in a venture capitalist / activist investor kind of way. Cut waste, cut costs and increase focus on the sections of the busisness that make money.

Final Takeaway: Does Growth Outweigh Decline?

Cost-cutting (store closures, SG&A reduction) could materially improve net income.

Revenue growth opportunities exist, but require execution—healthcare & digital pharmacy must offset retail declines.

Investors need to assess if Walgreens is cutting fast enough and growing smart enough to sustain long-term value.

Activist Investor Perspective

If Walgreens were taken over by a venture capitalist or an activist investor, the focus would likely be on:

Cutting waste, cutting costs, and increasing focus on the most profitable parts of the business.

Divesting unprofitable retail segments while maintaining dominance in pharmacy and healthcare services.

Pushing digital transformation to compete with online pharmacy disruptiors.

Walgreens is at a crossroads—either it executes a turnaround or risks further decline. The next few quarters will be critical in determining its financial stability and future growth potential.