Weird to think that Leggings would be worth looking at but here we are. We already did DECK prior in another other article. You can read that one here.

Balance Sheet

Cash & Equivalents: $1.3 billion

Property & Equipment: $1.8 billion

Store Leases: $1.5 billion

Inventory (“Leggings”): $1.6 billion

Total Liabilities: $3.14 billion

With no interest-bearing debt and a cash cushion equal to its liabilities’ short-term portion, Lululemon is financially resilient.

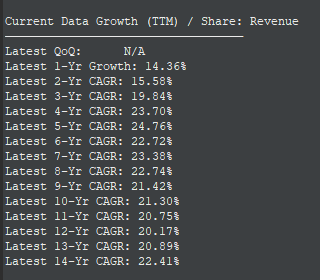

Revenue Growth

14-Year CAGR: 20%

Revenue has compounded at 20% annually for the past 14 years, and the stock now trades at its lowest price-to-sales multiple in 15 years.

Net Income

+20% CAGR across every time period.

With a 20% growth rate and a P/E of 15.21 LULU has a PEG ratio of .76 which makes it attractive from a Lynchian(?) perspective. Either way the growth rate is great and if the market is willing to give 20% for 15 dollars, I’ll take it.

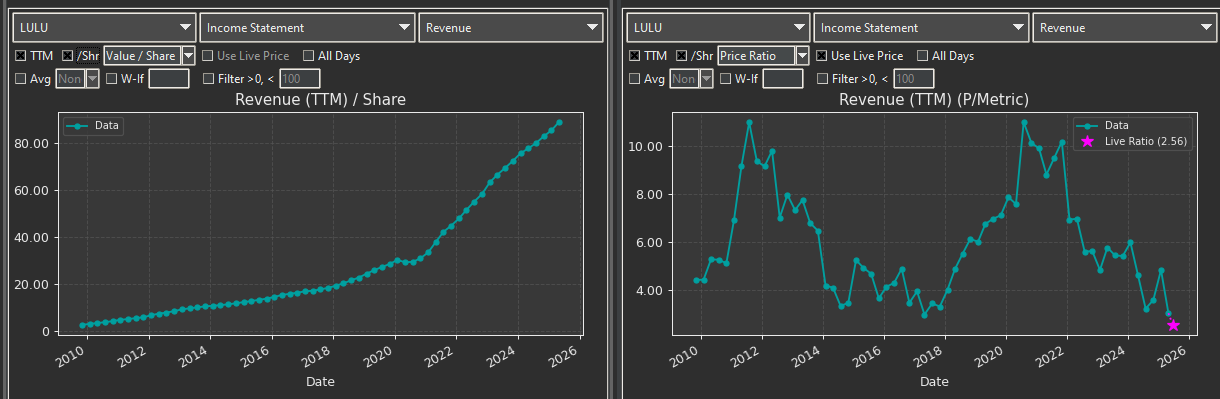

Free Cash Flow

Another 20% CAGR

Historically low FCF multiple. Near its long term CAGR. It would be hard to say that LULU does not ever trade again above a 30 multiple. Given its growth rate and current price its fairly valued presently in this category.

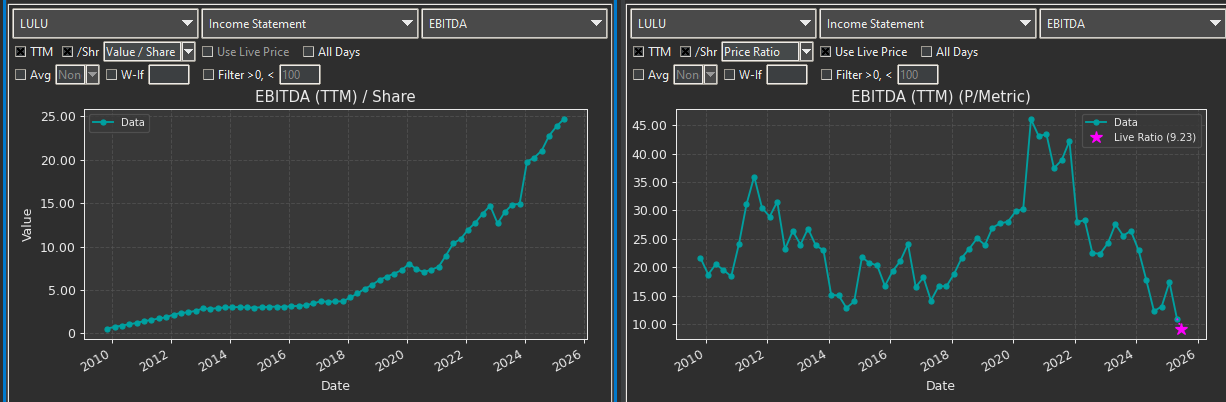

Cash Flow from Operations (CFFO)

Softening expectations here to (checks notes) 20% CAGR again.

With a P/CFFO ratio of 13.57 the 20% CAGR pushes this deep into a Lynch ratio of .67

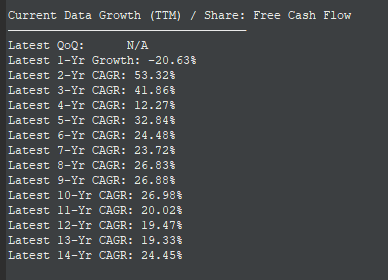

EBITA/EBIT

Both EBIT and EBITA show the same consistent growth of 20% we have seen thus far from Lululemon.

20% compared to sub 10 multiples. .5 ratios now.

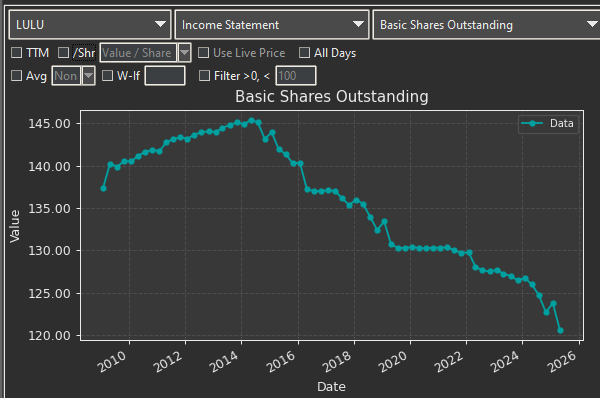

Share Count

LULU keeps buying back shares. Thats a plus. Did I mention they do not have any debt? Liabilities sure but no debt.

Store Footprint

Tariffs be damned were going to open more stores - Lululemon probably

Store growth of 10–15% annually largely fuels the company’s compounding metrics. By comparison, The Gap operates ~3,500 stores—suggesting significant runway remains.

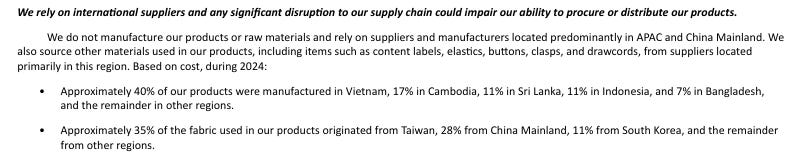

Roughly 28% of Lululemon’s fabric comes from China, but its largest suppliers are in Vietnam and Taiwan. This diversified sourcing helps mitigate tariff risk.

Margins/ROE/ROA

Gross Margin: 60%

Operating Margin: 23%

Net Margin: 17%

Return on Equity (ROE): 42%

Return on Assets (ROA): 24%

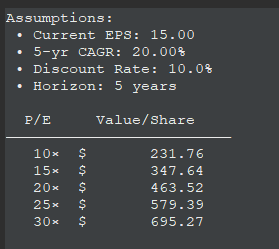

DCF

Given Its current share price of 225 Even at a 10 multiple, it’s still undervalued.

assuming even a worst-case scenario that growth slows to 10%

225 is priced appropriately at a 15 multiple.

Investment Thesis

Pristine Balance Sheet: No debt, ample cash.

Consistent 20%+ Growth: Across sales, earnings, and cash flows.

Undemanding Multiples: Valuations at decade-lows.

Expansion Catalysts: Continued store rollouts, deeper international penetration, and margin uplift from digital sales.

With its blend of strong fundamentals and attractive GARP (growth at a reasonable price) characteristics, Lululemon stands out as a high-conviction, long-term buy.