In this retail clothing saga with two prior articles covering LULU and DECK, we have CROX. If you’re wanting to see either of these other tickers, you can read about them here.

Ok onto CROX!

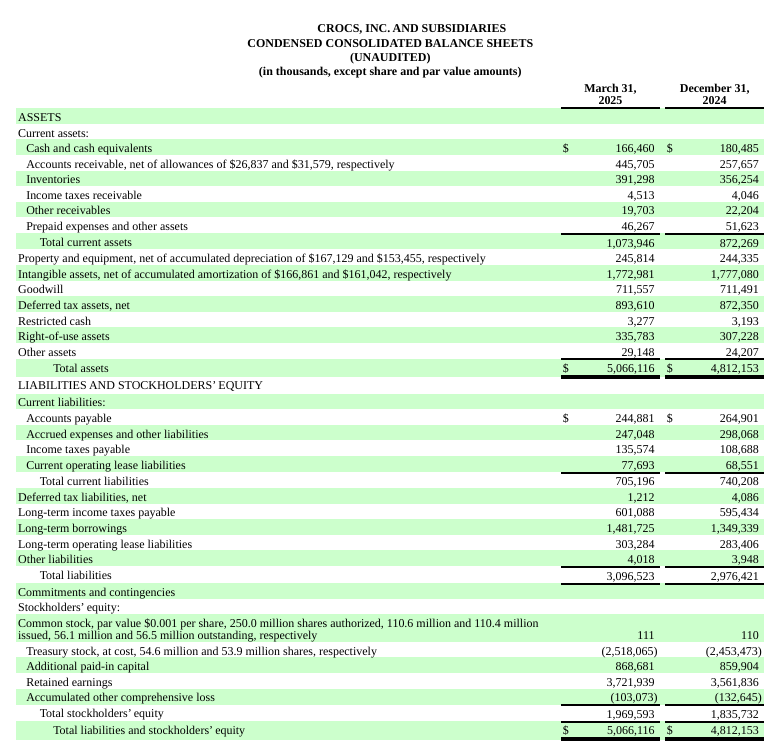

Balance Sheet

$391 M in Crocs

$166 M in cash

$445 M in accounts receivable

$1.07 B in factories and property

$1.72 B in intangible assets

$711 M in goodwill

$893 M in deferred tax assets

$335 M in right-of-use assets

You could comfortably discount about $2 B and still fully cover their liabilities.

Revenue

Even though trailing-twelve-month revenue is stalling, revenue per share is rising thanks to share buybacks.

Over the past 14 years, revenue has grown on average 18% annually possibly even mid-20s.

The current revenue multiple of 1.42 sits at the 54th percentile of its historical range.

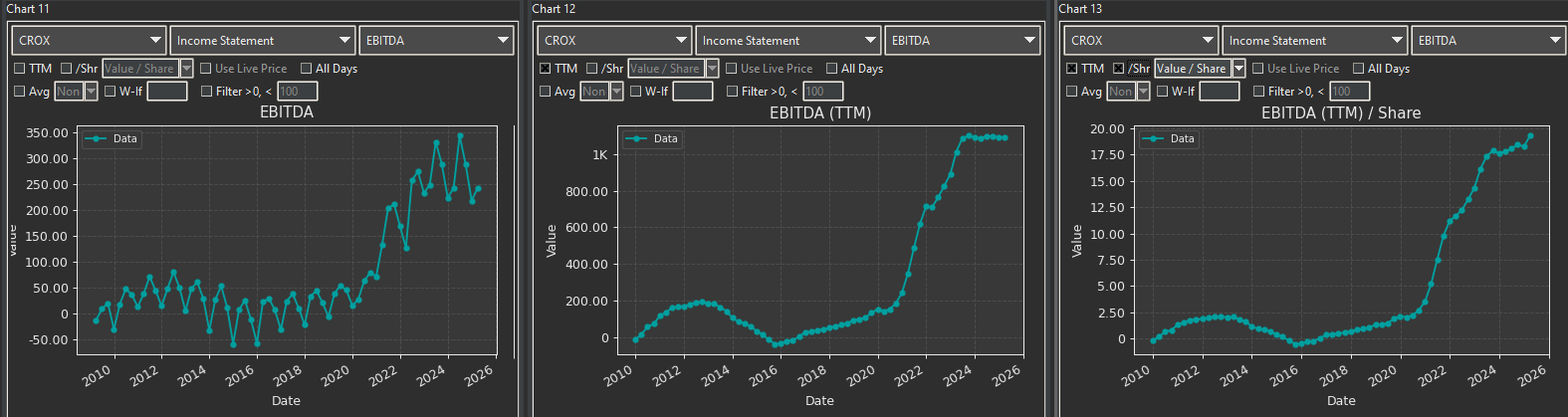

EBITA (The EBIT looks the same)

EBITA growth has ranged between 20% and 30%.

Near historical lows.

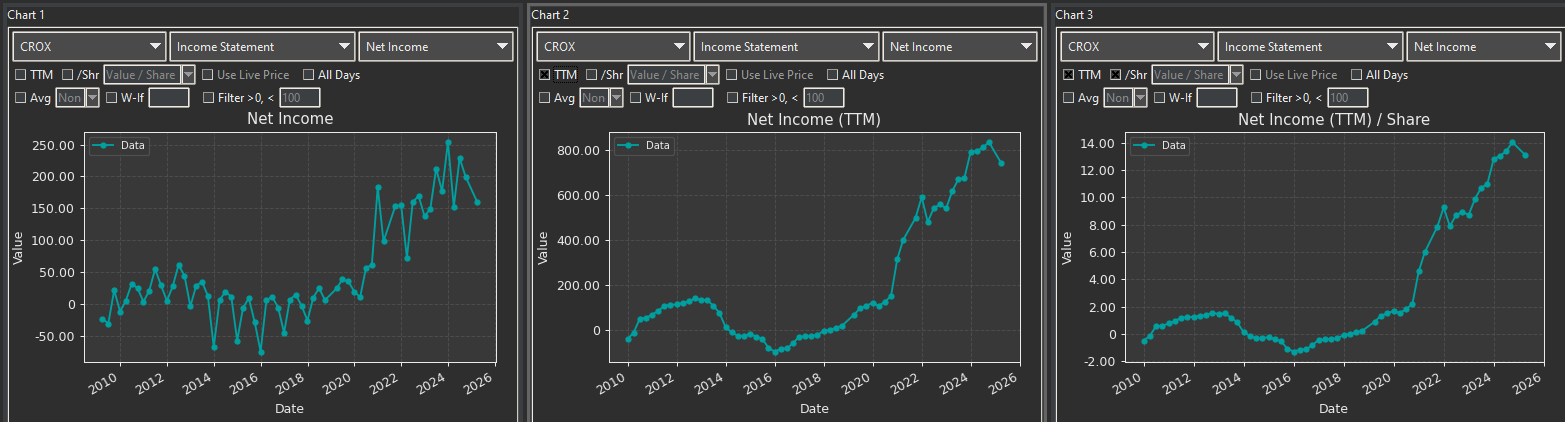

Net Income

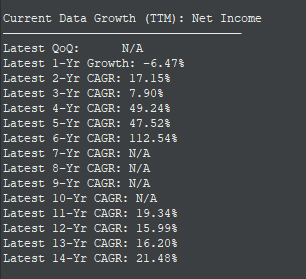

CROX endured a four-year stretch without profitability, but both TTM and per-share net income have since grown at long-term rates of 17% and 20%, respectively.

Another historically low multiple.

Free Cash Flow

TTM growth: 20%

Per-share growth: 25%

Nine consecutive years of positive free cash flow

At a current P/E of 8× (excluding P/Es above 40×) and 25% growth, CROX stands in the rare category of driving multiple expansion purely through its growth profile.

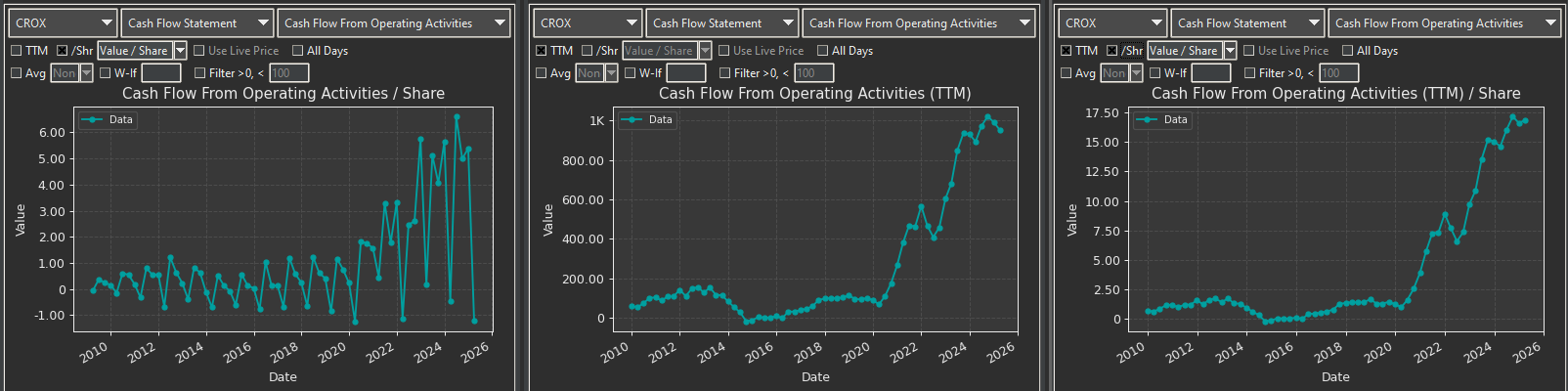

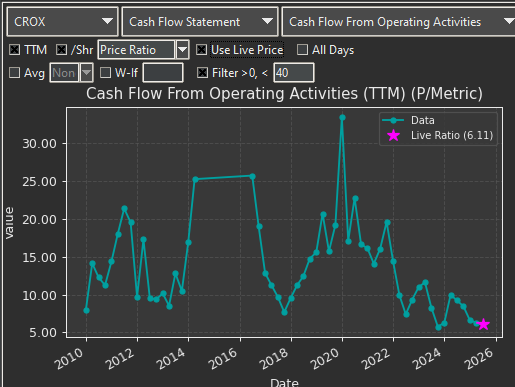

Cash Flow From Operations

18-25%? I mean you get the point. Now for the multiple.

Growth of 18–25%. The P/CFFO ratio sits at a historically low 6× despite double-digit cash-flow growth.

Margins/ROE/ROA

Gross margin: 59%

Operating margin: 25%

Net profit margin: 23%

Return on equity: 48%

Return on assets: 19%

I even compared them with values from finviz. see below. Ill assume that ROIC is correct as well.

Share Count

90 → 56M shares. I mean just unreal.

The Company

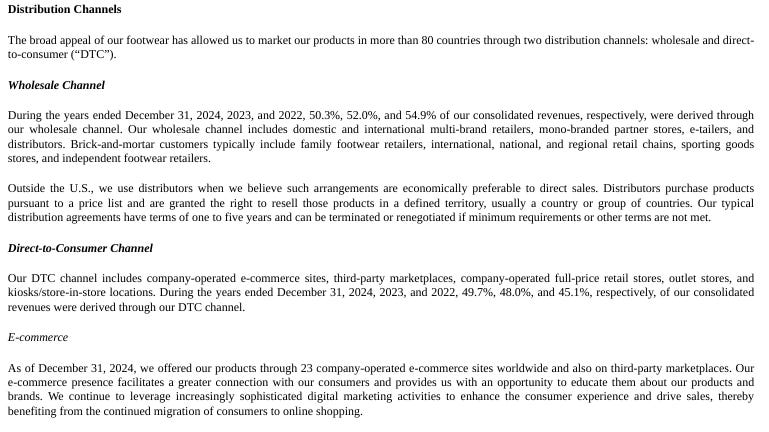

CROX has deeply penetrated the U.S. market—virtually everyone knows or owns a pair. There are roughly 7,000 U.S. stores versus only 390 company-operated stores globally.

While CROX favors Direct-to-Consumer (DTC) for superior margins, its global store expansion underscores a strategy to build brand awareness and market share in underpenetrated regions like China and India. The company themselves remain cognizant of any headwinds

DCF

Given Crocs’ track record, assuming 20% annual growth is reasonable even though post-COVID expansion averaged closer to 30% over the past six years. At today’s $107 share price, a return to a low-teens valuation multiple could double or even triple the stock.

Halving the growth assumption would lower those targets, but multiple expansion alone could still drive a recovery above current level. With a 25% ROIC, robust growth metrics, and historically low multiples, the market’s caution works to our advantage.